Microcredit platform for India

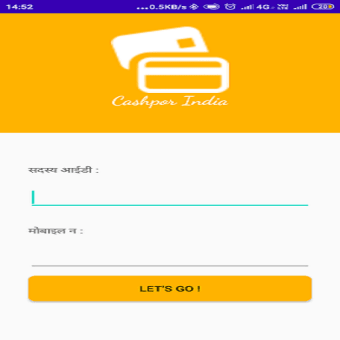

Cashpor India is a free finance application for mobile devices coming from Cashpor Micro Credit. It is a personal loan platform that caters to the financing needs of low-income households in rural areas across India. It helps users finance income-generating activities and jumpstart slow and steady earnings.

Top Recommended Alternative

Compared to other services like Cash Planet - ऑनलइन लन ऐप or CashIn - Personal Loan Online App, Cashpor India caters to a very specific demographic: rural residents. It encourages people to find sources of income like business ventures by providing them with a credit line to draw capital from.

Get money to earn money

Earning money is essential in order to finance the daily expenses of life, whether it be paying rent, buying groceries, or other must-haves. As the saying goes, however, 'you need money to make money', and not everyone has the financial capability to do so, especially those who are unemployed. Enter Cashpor India, a microfinancing platform specifically made for residents of rural areas in India.

It basically lets you apply for small personal loans to acquire funds for business ventures, such as offering products and services, or other income-generating activities. To become qualified, you will need to undergo a thorough application and screening process that will determine your CASHPOR Housing Index (CHI), Poverty Probability Index (PPI), and other criteria to see if you're qualified to apply for a loan.

Once you finish registration, you can then proceed to apply for a loan, indicating how much you need, as well as specify payment terms for principal due, installment amount and dates, and other pertinent information. Having said all that, just be aware that the whole application will go through a strict and thorough screening process. As such, there is no guarantee that you will get approved.

Finance your business

All in all, if you live in the rural areas that it services and you qualify to apply for a loan, then Cashpor India is an option you can consider for your microfinancing needs. You can ask for any amount you need and it lets you choose which payment terms work best for you. While there's no guarantee, it's still worth a shot and is recommended for users to try.